Accounts payable (AP) is a crucial finance function that handles invoice processing, vendor payments, reconciliation, reporting, and compliance. AP ensures that your firm has a cost-effective, accurate, and streamlined vendor management process.

AP processes are essential for compliance and security, vendor satisfaction and performance, service continuity, and the overall financial well-being of an organization.

However, managing accounts payable is a highly time-consuming, manpower-intensive, and financially demanding process. As your business grows, the volume of invoices and payments might overwhelm internal teams, hampering their ability to focus on core competencies and strategic initiatives. Hiring additional staff will not be an option for firms, as they focus on cutting costs and optimizing finances.

Many CFOs and accounting firms prefer accounts payable outsourcing services as a means of unburdening internal resources, saving on hiring costs, improving risk management, and accessing specialized expertise.

So, what exactly are the gains on ROI that CFOs are targeting for?

Benefits of Outsourcing

Accounts payable outsourcing providers offer tangible benefits to customers – whether they are large CPA firms, global conglomerates, or boutique firms.

We serve accounting firms across the US and Canada, helping them significantly improve margins, scale without increasing headcount, and adopt the latest technologies. Outsourcing is best suited for CPAs and smaller firms, as it frees up time and resources for high-value tasks.

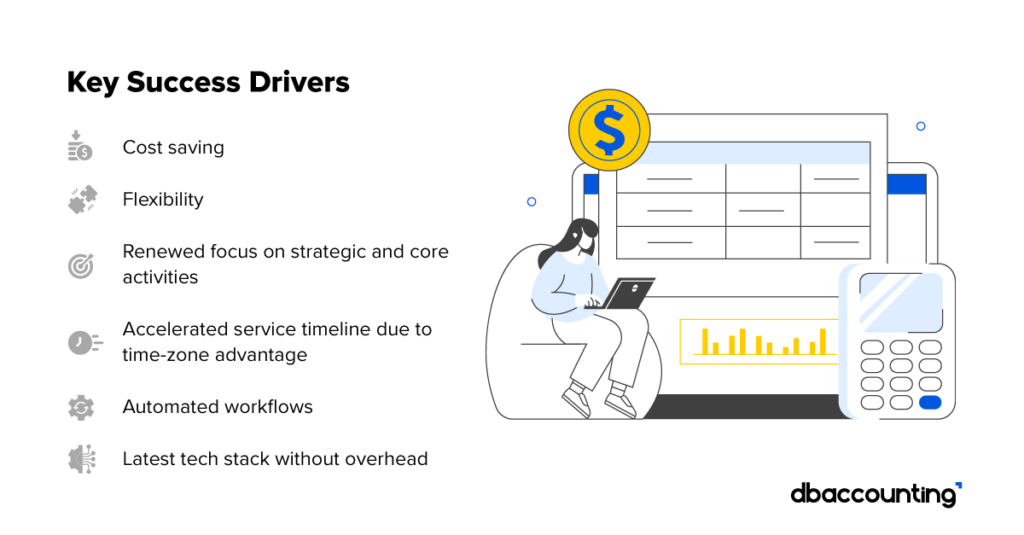

Outsourcing when done right, delivers:

However, CFOs need to look beyond the obvious and decipher how accounts payable outsourcing can help their business thrive and grow in today’s unpredictable market, ultimately gaining a competitive advantage.

Here are a few critical KPIs that need to be tracked and measured to assess the ROI of accounts payable outsourcing accurately.

1. Accuracy

Accuracy is one of the most critical key performance indicators (KPIs) for measuring the performance of an accounts payable outsourcing service provider. It is non-negotiable and is the baseline for trust and reliability.

With enhanced accuracy comes cost savings in terms of reduced rework, escalations, and associated overhead. Payments are made promptly, and vendor satisfaction is ensured.

For CPA firms, this is of utmost importance, as it can either break or build client trust.

An established threshold ensures that errors remain within acceptable limits, allowing you to achieve optimal results.

According to the Institute of Finance & Management (IOFM):

- Top-performing organizations achieve an invoice accuracy rate of 99%

- Lower-performing organizations average around 95%

This benchmark highlights how even a 4% variance in accuracy can significantly affect operational efficiency, vendor relationships, and cost management.

When outsourcing accounts payable or broader accounting functions, targeting a provider that consistently meets or approaches the 99% benchmark is crucial for maintaining quality, compliance, and financial clarity.

2. Speed

The time taken to process invoices, from receipt to payment, is a vital performance indicator of the success of accounts payable outsourcing services. This is also known as invoice cycle time.

According to the American Productivity and Quality Center (APQC), the average invoice processing time for the top performers in the industry is 2.8 days. According to another study, on average, it takes AP departments approximately 9.2 days to process one invoice, indicating that many workflows remain manual and time-consuming.

Shorter cycle times translate into financial agility, operational efficiency, and strong vendor performance. Shorter AP cycles help you better predict and manage cash outflows, enabling more accurate forecasting and planning.

It gives finance teams visibility and control over working capital. With timely payments, businesses can also capitalize on early payment incentives, thereby improving the profitability of the process.

High-quality AP outsourcing providers strive for best-in-class performance metrics, including:

- 3–5 business days from invoice receipt to payment for standard, non-exception invoices.

- Faster cycles (1–3 days) are possible with full automation, straight-through processing (STP), and strong ERP integration.

- >>90% straight-through processing rate as a target for automated workflows.

3. Cost of Invoice Processing

The State of ePayables 2024: Money Never Sleeps, a new report from Ardent Partners, has some eye-opening pointers for CFOs considering accounts payable outsourcing. Accounts Payable (AP) teams currently spend an average of $9.40 to process a single invoice, reinforcing that “there is still plenty of room for improvement.”

The report also states that top-performing accounts payable teams have lesser invoice processing costs by up to 78% and accelerated processing times by 82% compared to their peers. These parameters are achieved by adopting AP automation and optimizing strategies, as well as cleaning, organizing, and better managing their data.

Trusted accounts payable outsourcing providers will be able to deliver a 50%–60% boost in productivity via automation, helping drive down costs and achieve optimized ROI.

4. Scope of Services

ROI is higher when outsourcing covers end-to-end AP services (invoice receipt, validation, matching, payment, and reporting). Limited scope (e.g., only invoice entry) may yield less significant returns.

Our procure-to-pay outsourcing services have been designed with years of expertise and intelligent insights to optimize your end-to-end procure-to-pay process, enabling maximum accuracy, a balanced financial statement, and optimal relationships with vendors. We leverage AI-driven solutions to drive efficiency across the procure-to-pay cycle, including accounts payable & invoice processing.

A provider that offers comprehensive, end-to-end AP outsourcing can ensure maximum ROI while:

- Delivering greater efficiency across the entire invoice-to-pay cycle

- Enabling centralized reporting and analytics

- Minimizing exceptions and payment delays

- Enhancing vendor experience with consistent communication and faster resolutions

- Improving compliance and audit readiness through better documentation and control

Conclusion

Accounts Payable outsourcing is no longer just a tactical cost-cutting move—it’s a strategic lever for improving operational efficiency, reducing risk, and unlocking long-term value. For CFOs, the ROI extends beyond lower processing costs; it also includes faster cycle times, stronger supplier relationships, enhanced compliance, and improved scalability.

However, realizing this ROI depends on choosing the right outsourcing partner—one that brings process expertise, automation capabilities, robust data security, and transparency. With the right strategy and provider, AP outsourcing can transform a traditionally manual back-office function into a future-ready, value-generating engine for the business.

Now is the time to evaluate: Is your AP process driving value—or just fulfilling invoices?