For small and mid-sized businesses (SMBs) and mid-market firms, accounting teams today face a perfect storm of challenges — rising transaction volumes, complex regulatory landscapes, and the constant pressure to “do more with less.” Manual processes and fragmented spreadsheets simply can’t keep up. Enter accounting automation — the catalyst for smarter, faster, and more reliable finance operations.

Far beyond simple data entry tools, modern automation leverages AI, machine learning, and intelligent workflows to streamline financial processes end-to-end. The result? Sharper accuracy, higher efficiency, and more bandwidth for strategic finance.

For CFOs and finance leaders, the question isn’t whether to automate — it’s how to do it right and where to start. Below listed are key benefits delivered by accounting automation, accelerating not only speed, accuracy and insights, but also improving customer experience and business outcomes.

1. The Accuracy Imperative: Eliminating Human Error

Even the most seasoned accounting professionals can make mistakes — especially when juggling high transaction volumes and tight closing cycles. A single data entry error can ripple through reconciliations, reporting, and even compliance, costing valuable time and credibility.

Accounting automation drastically reduces that risk. By automating repetitive and error-prone tasks like:

- Invoice data capture and coding

- Bank reconciliations

- Journal entries and adjustments

- Payroll calculations and tax deductions

Automation ensures consistency and precision in every step. Intelligent OCR (Optical Character Recognition) and AI-based data validation systems can extract, verify, and categorize data automatically — with up to 99.9% accuracy when properly configured.

For CFOs, this means fewer late-night reconciliations, fewer audit corrections, and greater trust in reported numbers.

2. Efficiency Reimagined: Doing More with Less

Time is one of the scarcest resources in finance. Manual accounting processes eat up hours of productive time — from chasing approvals to cross-checking spreadsheets.

Automation optimizes these workflows by enabling:

- Touchless invoice processing: Automatically routes invoices through approval chains and flags exceptions.

- Real-time reconciliations: Continuously match transactions across systems to eliminate end-of-month bottlenecks.

- Automated reporting: Generates dashboards and management reports at the click of a button.

According to industry benchmarks, automation can reduce processing time by up to 58% for everyday F&A tasks like AP, AR, and month-end close.

The real win, however, isn’t just in time saved — it’s in where that time is reinvested. Freed from rote tasks, finance teams can focus on analysis, forecasting, and performance improvement.

3. The Compliance Advantage: Always Audit-Ready

For growing SMBs and mid-market firms, regulatory compliance is becoming increasingly complex. Tax codes change, global operations introduce new jurisdictions, and auditors expect transparency at every level. Many businesses struggle to stay audit-ready because they adopt a reactive stance, staying unprepared with no compliance calendar or tracking process till the audit is due.

Automation introduces structured, traceable workflows that make compliance second nature. It helps build a single source of truth with visibility across assets, controls, and monitoring, producing a clear and comprehensive picture of the audit landscape.

Every action is logged — from who approved an invoice to when a payment was made — ensuring a clear audit trail.

This reduces the likelihood of:

- Missing documentation during audits

- Non-compliance penalties due to manual oversight

- Time lost recreating historical records

With automated systems, audit readiness becomes continuous, not a quarterly scramble.

4. Real-Time Insights for Smarter Decision-Making

Manual accounting creates data latency — reports reflect what happened last month, not what’s happening now. In volatile markets and during times of uncertainty and evolving regulatory and tariff requirements, that lag can be costly. Forward-looking audits help businesses stay pivot-ready, market-aware, and effectively customer-centric. Anticipating and continually assessing risks helps you manage downside risks and optimize upside risks (potential opportunity).

Automation platforms consolidate financial data in real-time from multiple sources — ERP systems, CRMs, banks, and procurement tools — enabling CFOs to see a live view of:

- Cash flow position

- Outstanding payables and receivables

- Expense patterns and anomalies

- Budget vs. Actuals

These insights allow for faster, evidence-based decisions on working capital management, credit risk, and investment priorities.

A finance leader equipped with real-time visibility is better positioned to manage liquidity and align financial strategy with business growth.

5. Cost Efficiency and ROI

A common misconception is that automation is expensive or suited only for large enterprises. In reality, modern cloud-based accounting platforms offer subscription-based, scalable pricing models that align perfectly with SMB budgets.

A Harvard Business Review article says that, according to a survey, 90% of respondents said they trusted automation solutions to get more done without errors, make decisions faster, and reduce stress.

By automating repetitive finance functions, organizations can:

- Reduce manual labor costs

- Minimize rework and error correction

- Shorten the financial close cycle

- Improve vendor and customer payment terms through faster processing

The combined effect is a leaner, more efficient finance function that delivers measurable ROI — often within the first year of implementation.

6. Human + Machine: The Future Finance Model

Automation isn’t about replacing accountants — it’s about elevating them.

The most successful finance teams are those that integrate technology with human expertise. Automation handles the heavy lifting, while finance professionals focus on:

- Analyzing trends and anomalies

- Interpreting data for business impact

- Driving strategic planning and forecasting

- Strengthening governance and risk management

A recent Microsoft study analyzing 200,000 Copilot chats reveals that while AI excels at supporting tasks like research, writing, and communication, it still can’t fully replace any single occupation — at least not yet. It’s a timely reminder that human judgment, creativity, and collaboration remain irreplaceable in the age of automation.

University of Toronto researcher Geoffrey Hinton, who worked at Google Brain until 2023, says that as AI develops, it may soon be more intelligent than humans, something that could be difficult to digest given that we are the most intelligent species walking on Earth now. Interestingly, he goes on to add that, to ensure AI doesn’t harm us, we need to infuse it with the best of us – benevolence and kindness. Humans bring a sense of judgment and fairness to critical jobs, and that is hard to replicate.

In essence, automation augments human judgment — not replace it. The result is a finance function that’s faster, smarter, and more resilient.

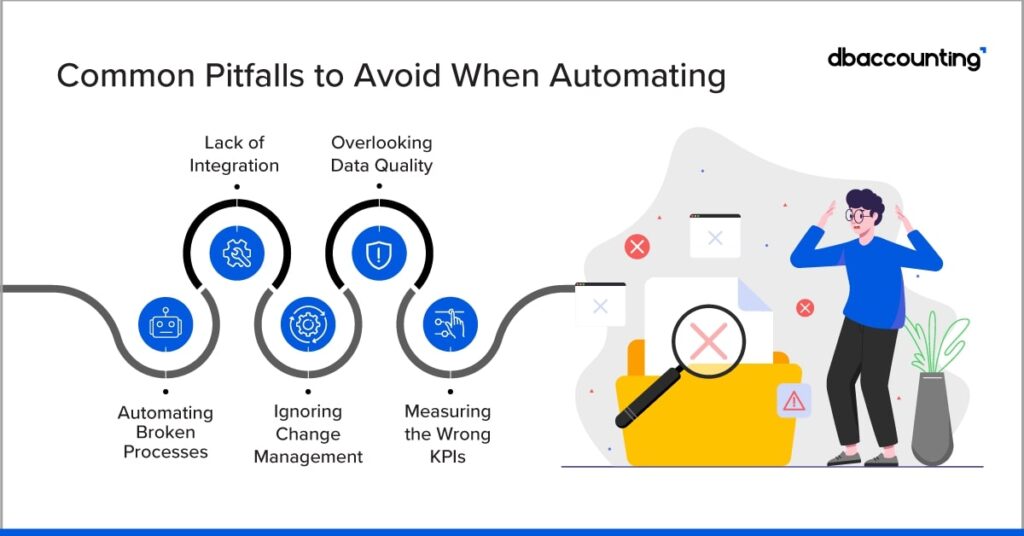

7. Common Pitfalls to Avoid When Automating

While the benefits are compelling, automation projects can underdeliver if not correctly managed. CFOs should watch out for these common pitfalls:

8. How to Get Started with Accounting Automation

For SMB and mid-market CFOs beginning their accounting automation journey, here’s a practical roadmap:

Step 1: Assess Readiness

Evaluate your current accounting processes — where are the bottlenecks, manual dependencies, or frequent errors?

Step 2: Prioritize Use Cases

Start small— by focusing on high-impact, low-risk areas like accounts payable, expense management, or bank reconciliation.

Step 3: Choose the Right Partner

Select a technology or outsourcing partner with deep domain experience in finance and automation. Look for scalability, integration capability, and compliance expertise.

Step 4: Build a Governance Framework

Define ownership, SLAs, and KPIs for automated workflows. This ensures accountability and continuous optimization.

Step 5: Iterate and Scale

Once initial success is proven, expand automation across functions — from FP&A and treasury to tax and audit support.

9. The Strategic Payoff for CFOs

The CFO’s role today goes far beyond accounting — it’s about steering the business strategically through uncertainty, disruption, and growth.

Accounting automation becomes a powerful enabler of that transformation. It frees finance leaders from transactional work, enhances control and compliance, and builds a foundation for analytics and AI-led insights.

With automated finance operations, CFOs gain:

- Speed: Faster close cycles and decision-making.

- Accuracy: Trusted data and minimal manual errors.

- Agility: Ability to scale operations without linear cost increases.

- Insight: Real-time visibility for proactive financial planning.

In short, automation turns the finance function from a cost center into a value creation engine.

10. Accuracy and Efficiency Delivers Double Advantage

In today’s dynamic economy, where every decision affects margins and growth, accuracy and efficiency in accounting are no longer optional — they’re existential.

For SMBs and mid-market firms, automation levels the playing field with larger competitors, empowering lean finance teams to perform with enterprise-grade precision and agility.

CFOs who act now — thoughtfully and strategically — won’t just optimize their finance operations. They’ll future-proof their business for the next wave of digital transformation.

Conclusion

Accounting automation isn’t just about faster books — it’s about smarter finance.

By integrating intelligent automation, mid-market CFOs can unlock new levels of accuracy, transparency, and performance — positioning their business to thrive, not just survive, in the digital era.

FAQS

Common tasks include data entry, invoice processing, expense report management, bank and credit card reconciliations, generating standard financial reports, and calculating depreciation or amortization.

Automation eliminates manual data input, which is the primary source of human error. It uses pre-defined rules and algorithms for calculations and data transfers, ensuring consistency and accuracy across all financial records.

ROI is typically realized through significant time savings (allowing staff to focus on analysis rather than data entry), reduced operational costs, and fewer financial errors, which prevents costly rework and potential penalties.

No. While large firms benefit greatly, many cloud-based accounting platforms offer affordable automation features (like automated bank feeds and reconciliation) that are highly beneficial for small to mid-sized businesses (SMBs) and individual CPAs.