Audits can be a stressful experience for any business, especially for SMBs with lean finance teams. The procure-to-pay (P2P) process — from purchasing to vendor payments — is often where inconsistencies, errors, and compliance issues surface. Manual processes leave too much room for mistakes, such as lost invoices, missing approvals, duplicate payments, or gaps in documentation. This is where procure to pay automation changes the game.

So, what is procure to pay automation? Broadly, it is the use of technology to streamline and integrate the entire purchasing and payment process — from requisitioning goods or services to paying suppliers. Instead of relying on manual paperwork and disconnected systems, P2P automation standardizes approvals, digitizes invoices, and ensures every step is tracked in a single workflow. The result is faster processing, fewer errors, stronger compliance, and a complete audit trail that gives finance leaders better control and visibility over company spend.

Let’s explore how automation streamlines audits, making them smoother, faster, and less stressful, particularly for SMBs seeking benefits beyond standard efficiencies.

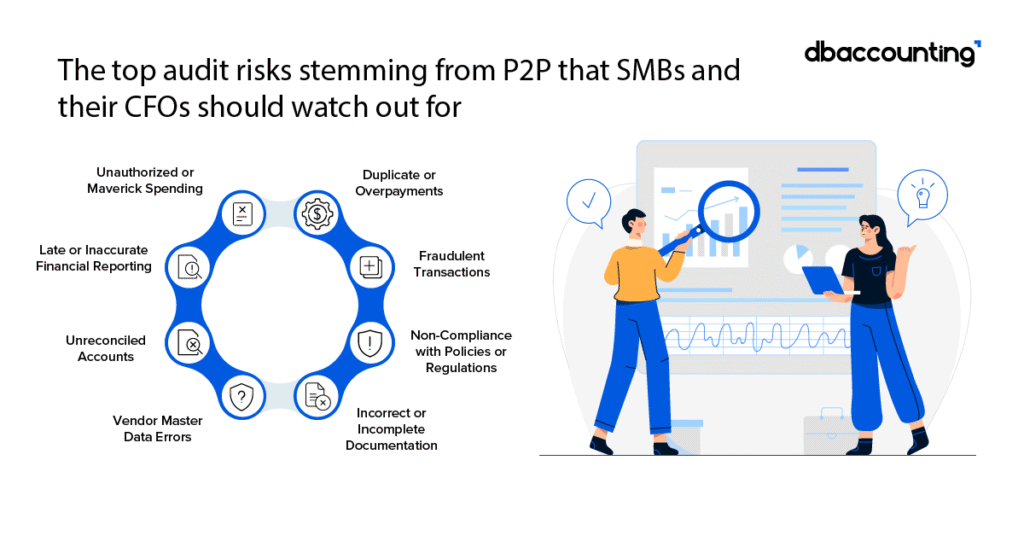

Top Audit Risks in P2P

P2P (Procure-to-Pay) processes are one of the biggest hotspots for audit risks because they touch so many transactions.

Unique Ways Procure to Pay Automation Helps SMBs

For small and medium businesses, procure-to-pay (P2P) automation offers more than just efficiency—it changes how finance teams work and how confident business leaders feel. Here are some less-talked-about advantages, which can strategically enhance the finance function by bringing in speed, accuracy, and agility.

1) Control rogue spend and enforce policy

Maverick spending happens when employees purchase goods or services outside approved channels, often bypassing negotiated contracts or policy rules. Procure-to-Pay (P2P) automation helps control this by enforcing standardized workflows — requiring purchase requisitions, approvals, and vendor selection through a central system. This ensures that every purchase is visible, authorized, and tied to a budget or project, reducing the risk of off-contract or unauthorized spend.

Additionally, procure to pay automation provides real-time spend visibility, allowing finance and procurement leaders to track who is buying what, from whom, and at what price. With built-in alerts and reporting, the system quickly flags non-compliant purchases and helps managers take corrective action. Over time, this not only reduces waste and fraud but also maximizes the value of supplier contracts and negotiated discounts.

2) Improve supplier trust and avoid penalties

P2P automation helps improve supplier trust by ensuring invoices are processed accurately and payments are made on time. Automated three-way matching (between purchase orders, invoices, and receipts) reduces disputes over mismatched data, while built-in approval workflows eliminate bottlenecks that often delay vendor payments. This reliability signals professionalism and consistency, which strengthens long-term supplier relationships.

It also helps SMBs avoid late payment penalties and strained cash flow by providing real-time visibility into upcoming obligations. Automated reminders and scheduling ensure that invoices don’t get lost in email chains or spreadsheets. With smoother transactions and fewer errors, suppliers are more likely to extend favorable terms, prioritize delivery, and collaborate better with the business.

Timely communication and collaboration with suppliers are also essential hallmarks of efficient AP organizations. When communication and self-service tools are not optimized, suppliers are forced to enquire with businesses about key milestones and invoice and payment processing. According to Ardent Partners’ AP Metrics that Matter in 2025 study, ‘best in class AP organizations spend 50% less time responding to inquiries. By minimizing the time AP staff spend on inquiries, they can focus more on strategic, value-adding activities.’

3) Gain better visibility and forecasting

For SMB CFOs, procure to pay automation delivers the kind of visibility that goes beyond just “tracking spend.” With centralized, real-time data, CFOs can monitor commitments across departments, anticipate cash needs, and model the impact of vendor payments on liquidity. Instead of waiting until the month-end reports, they gain proactive insight to steer strategy, protect margins, and adjust spending before minor issues turn into considerable financial pressures.

On the audit side, automation reduces the personal risk CFOs face when financial controls are questioned. Every step in the procure-to-pay process is documented and compliant by design so that CFOs can demonstrate strong governance with ease. This not only shortens audit cycles but also boosts leadership’s confidence in the finance function — positioning the function as both a strategic partner and a safeguard of organizational integrity.

4) Reduce costs and avoid error rework

P2P automation reduces costs by cutting down the manual effort required to process invoices, manage approvals, and reconcile payments. Instead of finance teams spending hours keying in data or chasing missing documentation, automated workflows handle routine tasks instantly. Studies show that automated invoice processing can cost up to 70% less than manual methods, freeing up resources that SMBs can redirect toward growth and strategy.

It also minimizes error rework — one of the biggest hidden drains on finance teams. Manual entry often leads to duplicate invoices, incorrect coding, or missed approvals, all of which take extra time and effort to fix. Automation ensures accurate matching between purchase orders, receipts, and invoices, catching discrepancies upfront and preventing errors from flowing into the books. This not only saves money but also reduces the frustration of repetitive clean-up work for finance staff.

New stats for CFOs about AP automation say that 68 percent of companies still waste time and money on manual invoice processing, and that 39% of invoices contain errors, leaving much to be desired.

5) Make audits easier & reduce risk of non-compliance

P2P automation makes audits easier by maintaining a complete, digital record of every transaction from requisition to payment. Each purchase order, invoice, approval, and payment is logged with timestamps and supporting documents, giving auditors instant access to the information they need without chasing paper trails or email threads. This transparency speeds up audit cycles and reduces the back-and-forth between auditors and finance teams.

As seen earlier, it also reduces the risk of non-compliance by enforcing policies and regulatory requirements within the workflow itself. Automated approval routing, spend limits, and vendor validations ensure purchases adhere to internal controls and external regulations. Exception alerts flag irregularities early, so finance leaders can address issues before they escalate into compliance breaches. Together, these features give SMBs confidence that their processes are audit-ready at all times.

Conclusion

In today’s regulatory and economic climate, SMBs cannot afford to leave audit readiness to chance. Manual P2P processes not only waste time and money but also expose businesses to hidden risks like errors, fraud, and compliance breaches. With procure to pay automation, CFOs gain a built-in safeguard: every transaction is controlled, documented, and transparent. The result is fewer surprises during audits, stronger supplier relationships, and greater confidence in financial reporting — all of which position the finance function as a driver of trust and strategic growth.

FAQS

It creates a complete digital audit trail, making records easy to access and verify.

Yes. Automated checks like three-way matching and real-time alerts flag risky or duplicate transactions.

It enforces policy adherence and regulatory compliance (SOX, GDPR, tax laws) at every stage.

By reducing manual data entry, it minimizes errors and improves reporting accuracy.