In today’s interconnected world, businesses of all sizes are expanding across borders — establishing subsidiaries, shared service centers, and strategic supplier relationships. With this global reach comes a complex web of intercompany transactions, particularly in the procure to pay cycle. And where intercompany flows exist, transfer pricing (TP) compliance becomes unavoidable.

For many organizations, transfer pricing is just ‘something that you have to do’. But centralizing and activating structured transfer pricing data has several benefits. It can deliver accurate insights, strengthening the entire business and empowering forecasting and decision-making. Aibidia’s new 2025 State of Transfer Pricing Report says that transfer pricing is fast becoming a strategic lever for resilience, efficiency, and growth.

When procurement, accounting, and tax teams operate in silos, inconsistencies in documentation, pricing, and approval processes can easily lead to non-compliance, financial penalties, and reputational damage. This is why mastering transfer pricing compliance within the procure to pay cycle is no longer just a finance exercise. It’s a strategic necessity — blending tax, procurement, and technology to ensure transparency, efficiency, and regulatory alignment.

Understanding Transfer Pricing in the Context of Procure to Pay Cycle

Transfer pricing governs how goods, services, and intellectual property are priced when traded between related entities within the same multinational group. It ensures these transactions are conducted at arm’s length — meaning, prices mirror what would be charged between unrelated third parties.

In the context of the procure-to-pay (P2P) process, transfer pricing becomes relevant every time:

- A shared service center provides procurement, finance, or IT support to a group entity.

- A parent company sources goods or services centrally on behalf of subsidiaries.

- A regional hub manages vendor relationships and redistributes costs across entities.

If these intercompany transactions are not priced and documented correctly, they can distort taxable income allocations across jurisdictions — triggering audits, adjustments, and penalties.

Why P2P and Transfer Pricing Are Interlinked

Many companies treat transfer pricing as a year-end documentation task, disconnected from operational finance. But in truth, transfer pricing risks are baked into the procure to pay cycle itself.

Consider these typical scenarios:

- A global procurement team negotiates vendor pricing, but allocations to local entities don’t reflect the actual benefit received.

- Intercompany recharges for shared services are posted manually, with inconsistent markups across regions.

- Purchase orders, invoices, and contracts fail to capture key TP terms such as service level, cost base, or markup percentage.

The result? Data fragmentation, inconsistent documentation, and audit exposure.

Embedding TP compliance directly into P2P workflows ensures every transaction — from purchase order to payment — is traceable, rationalized, and audit-ready.

The CFO’s Challenge: Balancing Control and Agility

For CFOs and controllers, mastering transfer pricing in the P2P cycle means balancing regulatory precision with operational efficiency. Too much manual control creates bottlenecks. Too little oversight leads to risk. Most finance leaders don’t mind paying tax; what they don’t want are surprises.

Key pain points in the efficient procure to pay cycle include:

- Fragmented Data: Finance, procurement, and tax systems often don’t speak the same language.

- Inconsistent Policies: Different regions apply TP policies differently due to a lack of centralized guidance.

- Reactive Compliance: Most organizations address TP issues post-facto — during audits or year-end reviews — instead of embedding controls upfront.

- Evolving Regulations: OECD’s BEPS guidelines and local filing requirements are constantly changing, requiring ongoing recalibration.

The solution? Integrate technology, governance, and expertise into a unified framework that automates compliance without slowing operations.

5 Key Steps to Embed Transfer Pricing Compliance in the Procure to Pay Cycle

1. Map Your Intercompany Flows

Start with visibility. Identify all intercompany relationships that impact the procure to pay cycle— from shared procurement to group-level vendor contracts.

Build a process map that connects each transaction to its originating entity, beneficiary, and pricing policy. This ensures that both your procurement and tax teams know exactly where value is created and how it is transferred.

Pro Tip: Use process mining tools to trace the flow of intercompany invoices through your ERP. This helps pinpoint inefficiencies and misalignments early.

2. Standardize Cost Allocation and Markup Policies

One of the most significant sources of TP risk in procure to pay cycle is inconsistent markup application on intercompany recharges.

Establish a standard cost allocation policy that defines:

- What costs can be recharged and to whom

- How markups are determined and reviewed

- Frequency of rate updates and benchmarking

Automate this policy within your ERP or accounting system so markups apply consistently at the PO or invoice creation stage—not during year-end reconciliations.

3. Digitize Documentation and Approval Workflows

Manual documentation is one of the main reasons TP compliance collapses under audit.

To fix this:

- Create digital audit trails for every intercompany transaction within P2P systems.

- Tag supporting evidence (contracts, benchmarking studies, SLAs) directly to invoices or POs.

- Automate approval workflows that include both procurement and tax compliance checkpoints.

This ensures each transaction has traceable substantiation — who approved it, under what policy, and at what markup.

4. Leverage Automation for Real-Time Monitoring

Today’s AI-powered P2P automation tools can go beyond invoice matching. They can actively monitor transactions for TP compliance in real time.

Here’s how:

- AI engines can flag non-arm’s-length markups or unusual cost allocations.

- Machine learning models can benchmark intercompany prices against external comparables.

- Dashboards can visualize TP exposures across entities, helping tax and finance teams act proactively.

By embedding transfer pricing controls within automation, CFOs gain both compliance and agility — with fewer manual interventions.

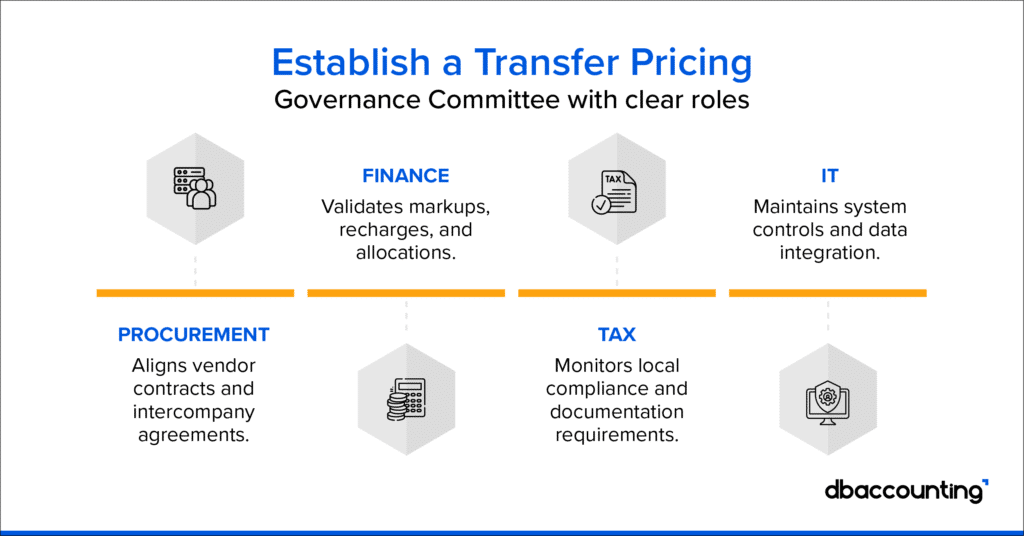

5. Build Cross-Functional Governance

Transfer pricing compliance is not the sole responsibility of the tax department. It’s a cross-functional effort involving procurement, finance, legal, and compliance.

Quarterly reviews between these teams help maintain alignment, assess policy effectiveness, and adjust for regulatory changes.

How Automation Enhances TP Compliance in P2P

Modern procure-to-pay platforms — especially those enhanced by AI and advanced analytics — can drastically reduce transfer pricing risks.

Automation helps by:

- Ensuring consistent cost classification across entities.

- Generating intercompany invoices automatically based on standardized markups.

- Providing real-time alerts for out-of-policy transactions.

- Maintaining centralized TP documentation accessible for audits.

Moreover, intelligent analytics provide CFOs with a “single source of truth” — linking financial data, supplier performance, and compliance indicators. This not only strengthens governance but also enhances decision-making around procurement strategy and spend optimization.

Common Pitfalls to Avoid

Even with automation, companies often stumble over a few recurring mistakes:

- Siloed Implementation: Automating procurement without aligning tax policies defeats the purpose.

- Static Benchmarking: Transfer pricing policies must evolve with market changes — update your markups regularly.

- Ignoring Local Variations: Global frameworks must accommodate local regulations and entity-specific nuances.

- Lack of Training: Employees across procurement and finance should understand TP basics — not just compliance officers.

- Overlooking Data Quality: Inaccurate master data leads to incorrect cost allocation and misclassification, increasing audit risk.

Avoiding these pitfalls requires a balanced mix of technology, expertise, and continuous oversight.

The CFO’s Takeaway: Turning Compliance into Competitive Advantage

Transfer pricing compliance is often viewed as a tax burden. But in the age of global digitization and interconnected supply chains, it can become a strategic differentiator.

By mastering TP within the P2P cycle, CFOs can:

- Improve global cost visibility and control

- Strengthen cross-entity collaboration

- Reduce audit risks and penalties

- Enhance financial transparency that builds investor trust

Ultimately, transfer pricing done right isn’t about paperwork — it’s about operational alignment. It transforms compliance from a reactive task into a proactive driver of efficiency, governance, and strategic clarity.

Conclusion

As supply chains grow global and tax regimes evolve, mastering transfer pricing compliance in the P2P cycle is now mission-critical.

By embedding compliance directly into procurement workflows, leveraging automation, and fostering cross-functional governance, SMBs and mid-market firms can future-proof their finance function — ensuring agility without sacrificing control. In the long run, it’s not just about staying compliant. It’s about creating a transparent, efficient, and intelligent procure-to-pay ecosystem that aligns finance, tax, and business strategy — powering sustainable global growth.

FAQS

This addresses the “why” and sets the stage by linking the two complex concepts.

This focuses on practical application, likely pointing to vendor selection, Purchase Order (PO) creation, and invoice/payment processing.

This brings in the fundamental TP principle and demands a clear, actionable explanation for procurements.

This provides forward-looking, “mastering” advice on automation and process design, which is key to the topic title.