Cash flow is the lifeblood of every business, but it often gets tied up in unpaid invoices, also called Accounts Receivable (AR). Even with healthy sales, slow collections can leave finance leaders scrambling to cover payroll, manage vendor payments, or fund growth. That’s why accounts receivable turnover isn’t just a finance metric—it’s a direct measure of liquidity and financial resilience.

Yet many finance teams still rely on manual spreadsheets and scattered reports to manage receivables. This lack of visibility makes it hard to answer simple but critical questions: Which customers are consistently late? How much working capital is at risk? Will collections align with cash flow forecasts? The result is reactive decision-making, mounting overdue invoices, and missed opportunities to strengthen financial control.

That’s where analytics and intelligent dashboards come in. By turning raw AR data into real-time insights, CFOs gain the tools to track payment patterns, forecast cash inflows, and prioritize collections strategically. For SMBs operating with lean teams and tight margins, dashboards aren’t just about reporting—they’re about turning AR into a proactive driver of stability and growth.

Why Accounts Receivable Turnover Matters?

Accounts receivable locks up the lifeblood of a business – cash. Although it can be argued that the late payments or lost revenue are recovered in later quarters, this has serious consequences.

When high-value invoices are not paid on time, SMBs struggle to pay salaries or make meaningful investments in technology, processes, and people. As a result, they tend to borrow irresponsibly, falter in financial control and compliance, and ultimately fall behind in innovation and growth.

According to a new survey, companies with annual revenue between $251M–$1B report the worst impacts, with 8.3% losing over 10% of their annual revenue to defaults. 1 in 10 companies surveyed said they lose more than 5% of their annual revenue to defaults. These are more than just statistics. They derail forecasts, inhibit plans, and reduce profits.

Accounts Receivable Turnover is a financial ratio that measures how efficiently a business collects payments from its customers.

In simple terms, it shows:

How many times, on average, your company collects its receivables (customer payments) during a specific period, usually a year.

Formula:

AR Turnover= Net Credit Sales / Average Accounts Receivable

- High AR turnover indicates that customers pay quickly, resulting in strong cash flow and effective credit policies.

- Low AR turnover indicates slow collections, with more cash tied up in receivables and a higher risk of bad debts.

For finance leaders, this ratio is a key signal of cash flow health, customer credit risk, and how well finance teams are managing collections.

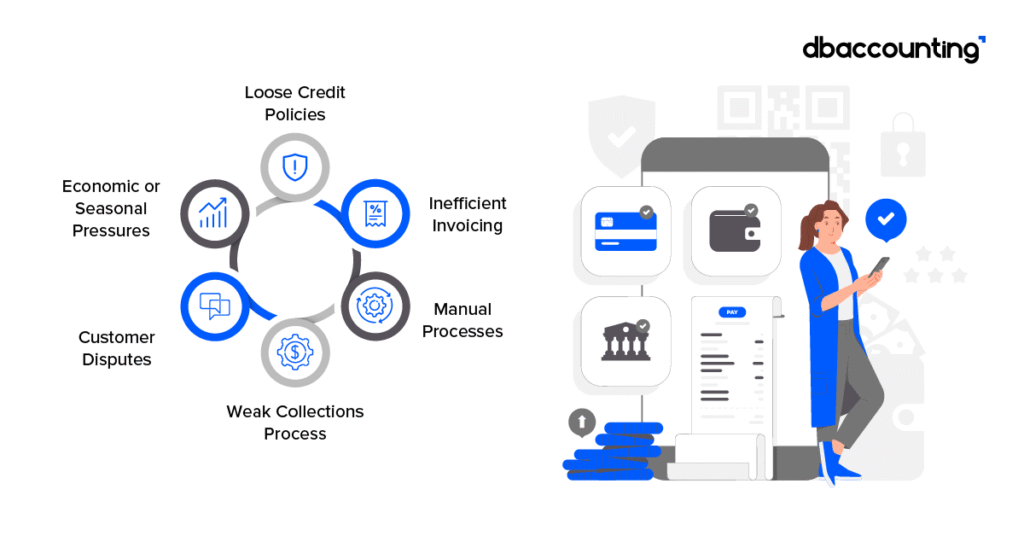

Factors Affecting The AR Turnover

A high accounts receivable turnover ratio is generally seen as a positive sign, but it can backfire if you achieve it by imposing overly restrictive credit policies that hurt sales. On the other hand, a low turnover ratio may raise red flags with lenders, yet it doesn’t always mean your customers are risky. In some cases, it reflects overly generous payment terms or working with larger clients who operate on extended cycles beyond 30 days. The key is to interpret AR turnover in the right context rather than viewing it as a standalone indicator.

Industry norms play a big role as well. For example, retailers and grocery stores naturally have higher AR turnover due to their payment structures, while B2B service providers often operate with longer cycles. This makes benchmarking against peers essential to gain meaningful insights. Ultimately, the most practical way to improve AR turnover is by tightening billing processes, reducing invoicing errors, and proactively managing collections—measures that not only strengthen cash flow but also build credibility with lenders and stakeholders.

When a high AR turnover is healthy:

- Strong invoicing and collections processes are in place.

- Credit policies balance risk and growth (customers aren’t deterred).

- Industry norms support fast collections (retail, groceries, e-commerce).

- It reflects disciplined working capital management.

When a high AR turnover is a red flag:

- Credit policies are too restrictive, limiting sales opportunities.

- Customers are pushed toward competitors offering more flexible terms.

- Growth is sacrificed in the name of fast collections.

- It creates tension in customer relationships if terms feel rigid.

In other words, context matters — you should measure AR turnover against industry benchmarks and their growth strategy, not just as a standalone metric.

How to Deal with Low Accounts Receivable Turnover

Several factors lead to a decrease in AR turnover.

By carefully analyzing your invoice and payment processes, you can identify the causes and systematically address the issues.

- Streamline invoicing and payment methods

Delays often start with invoicing. Automating invoice creation and delivery ensures customers receive accurate bills on time. Offering multiple digital payment options (ACH, credit card, online portals) also makes it easier for customers to pay quickly, reducing lag in collections.

- Strengthen follow-up and collections policies

Proactive reminders before and after due dates help reduce overdue accounts. A structured collections process — with defined escalation steps — ensures no invoice slips through the cracks. Clear communication and consistency also set expectations with customers that timely payments matter.

- Align credit terms with customer behaviour

Reviewing customer payment history and industry standards allows businesses to tailor credit terms. For reliable, long-term customers, flexible terms may be justified, but for high-risk or late-paying accounts, stricter terms (or deposits) can protect cash flow and boost turnover.

Together, these process improvements not only accelerate cash inflows but also improve customer relationships by creating transparency and predictability.

How Analytics and Real-Time Dashboards Improve Accounts Receivable Turnover

Dashboards turn raw AR data into actionable insights, helping SMBs fix inefficiencies, manage risk, and improve turnover without alienating customers. Many AR solutions are now cloud-based, enabling access and visibility from anywhere.

Agentic AI can be embedded into everyday tools gathering data across operations, suppliers, markets and other economic feeds. To enhance and customize dashboards for CFOs and other key decision makers, these agents connect live data with visualization systems, providing dashboards that evolve in real time.

Benefits of AR dashboards:

- Real-Time Visibility – Dashboards track overdue accounts instantly, so you know where cash is stuck.

- Aging Analysis & Segmentation – Analytics highlight risky customers, late-payment patterns, and high-value overdue accounts to focus collection efforts.

- Predictive Insights – Machine learning or trend analysis forecasts which accounts are likely to default or delay, letting AR leaders adjust credit policies early.

- Automated Tracking & Alerts – Dashboards set reminders for invoices nearing due dates, reducing delays caused by missed follow-ups.

- Cash Flow Forecasting – By tying receivables to cash flow models, you can plan borrowing, investments, or expense management with confidence.

- Performance Metrics – KPIs like DSO (Days Sales Outstanding) or Collection Effectiveness Index give a clear measure of improvement over time.

What Are the Key Metrics to Track on Your AR Dashboard?

Tracking AR metrics isn’t just about collections; it’s about cash, control, and confidence. Ensure that your accounts receivable dashboard has essential core features, including customization, automated KPI alerts and reminders, and robust filter and drill-down tools.

A smooth accounts receivable (AR) process that ensures steady cash inflows is essential for business sustainability. While companies have long relied on billing and AR software to track receivables, the most efficient organizations now leverage AR dashboards. These dashboards provide a visual hub of key performance metrics, offering real-time insights into invoice status and overall AR health, and turnover. By providing teams with a single, easy-to-read source of truth, AR dashboards enhance productivity, improve decision-making, and ensure everyone is aligned in driving faster, more reliable collections.

Key metrics to track accounts receivable turnover:

Days Sales Outstanding (DSO): Measures the average number of days it takes to collect receivables. A high DSO signals slower collections and possible cash flow strain.

Average Collection Period: Shows how long, on average, customers take to pay. Useful for benchmarking against industry norms.

Accounts Receivable Turnover Ratio: Indicates how efficiently receivables are collected during a period. Higher ratios usually mean faster collections.

Aging Buckets (by 0–30, 31–60, 61–90, 90+ days): Helps identify overdue invoices and chronic late payers.

Collection Effectiveness Index (CEI): Measures how successful the collections team is at turning receivables into cash within a given period.

Bad Debt to Sales Ratio: Tracks the percentage of sales written off as uncollectible, highlighting credit risk.

Dispute/Invoice Error Rate: Shows how often invoices are delayed or unpaid due to errors, helping pinpoint process inefficiencies.

Percentage of AR Past Due: Reveals what portion of receivables is overdue — a quick snapshot of credit health.

Cash Summary: Incoming cash flow, summarized by days, weeks, or months, and projected cash receipts, helps in accurate forecasting.

Top Customers: Ranks customers according to amount owed or transaction volume, helping identify top delinquent and top paying customers.

Together, these metrics give you a 360° view of AR performance — from efficiency and risk management to team effectiveness.

Conclusion

Improving accounts receivable turnover isn’t just about chasing payments — it’s about giving the C-suite and finance teams the visibility, insights, and control to manage cash flow strategically. By leveraging analytics and intelligent dashboards, businesses can spot bottlenecks, refine credit policies, and make smarter, data-driven decisions. The result: faster collections, stronger customer relationships, and a healthier balance sheet that supports long-term growth.

FAQS

Accounts receivable turnover is a financial metric that shows how efficiently a company collects payments from its customers. It measures how many times, on average, a business converts its outstanding receivables into cash during a specific period (usually a year). A higher turnover indicates that customers are paying their invoices quickly, while a lower turnover suggests delays in collections.

A “good” accounts receivable turnover ratio varies by industry, but in general, a ratio between 6 and 12 is considered healthy. This means a business is collecting its receivables every one to two months.

A higher accounts receivable turnover ratio is typically better, as it shows that customers pay on time and the business quickly converts credit sales into cash. A lower turnover is generally a red flag, indicating slow collections or potential cash flow issues.

Businesses can improve accounts receivable turnover by leveraging analytics, dashboards, and automation to track payments, send reminders, and streamline collections. Clear credit policies, multiple payment options, and regular AR reviews help identify bottlenecks and enable faster, more proactive collection cycles.